People start and sell management companies for many reasons. Regardless of the reason for exiting, having a strategy in place allows owners to maximize the value of their business, make it attractive to potential buyers, minimize taxes, and achieve their personal and financial goals.

It also allows owners to leave the legacy they desire and take care of both their employees and clients they have served and helped get them to the point of exit.

There are four basic types of exits, each with its pros and cons including the value the owner will receive. These are:

- Liquidation

- Third-party sale to a competitor (M&A), existing management (MBO), or the employees (ESOP))

- Issue a public offering (IPO)

- Transfer to family members

Before determining which type of exit strategy is right for you, it’s important to understand what your management company is worth.

Understanding the Components of a Value Calculation

Management company valuation continues to be perplexing for many owners. There are EBITDA multiples thrown out, “stories” of how much competitors sold for, and then there is the intrinsic “gut” feeling every owner has as to how much their company is worth.

So how do you value your company?

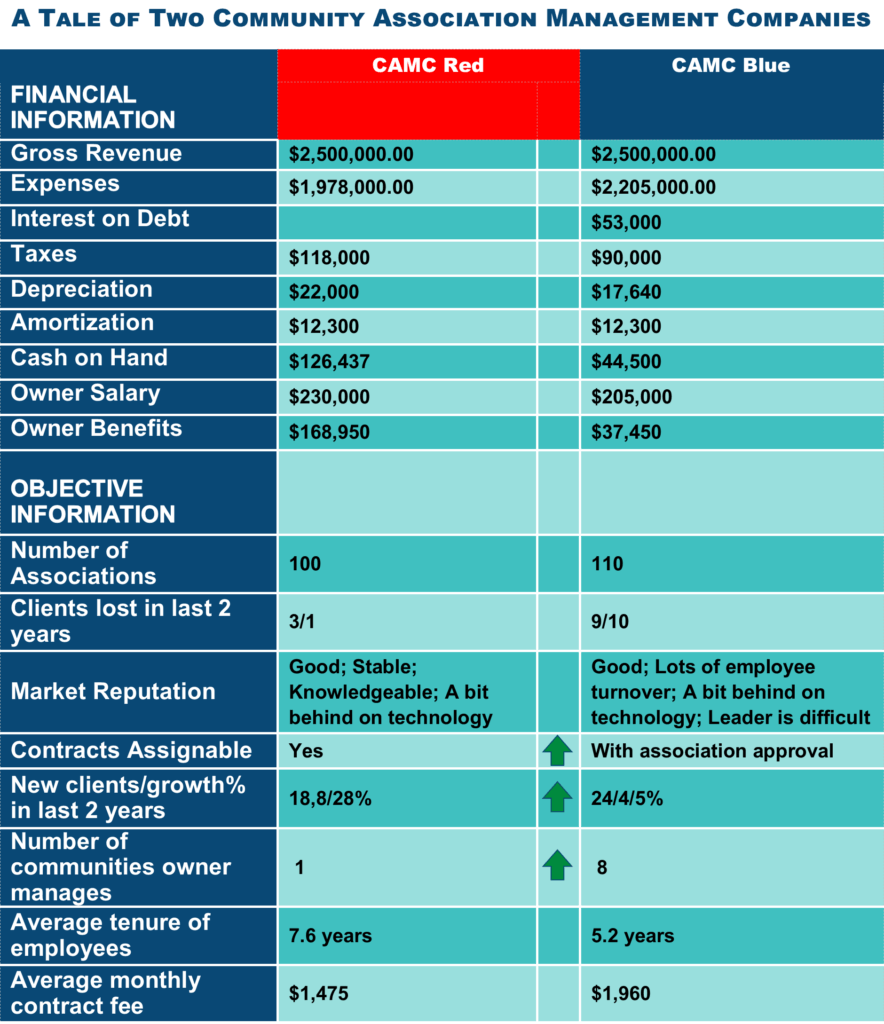

To understand the actual components of a value calculation, we offer “A Tale of Two Community Association Management Companies.”

From the outside CAMC Red and CAMC Blue look remarkably similar. They are both in the same market, have a mixture of condominiums and single-family homes under management, and use the same software. Their overall size is comparable as is their office space.

However, what is below the surface is quite different.

To establish management company valuation, there are three main components that must be reviewed:

- Enterprise Value of the Company

- Adjustments Based on Industry/Market Comparables

- Adjustments to Enterprise Value Based on Debt/Cash

Enterprise Value

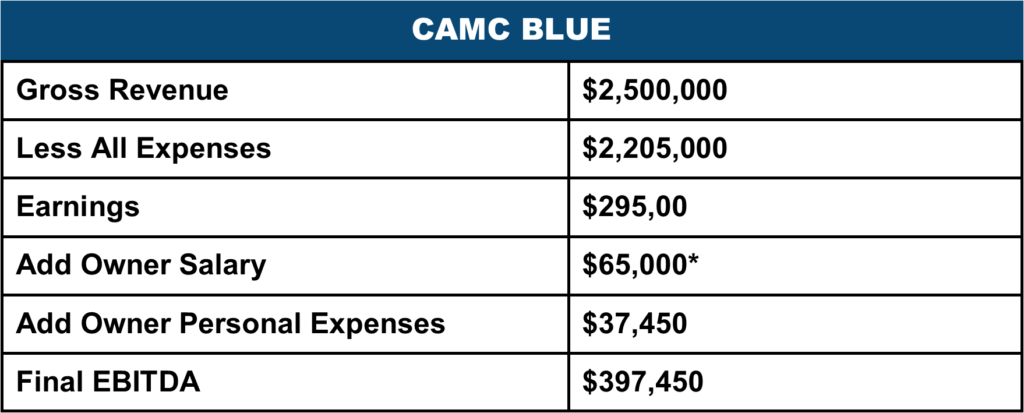

Enterprise Value is calculated by first determining the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of the company. After this is calculated, any expenses your company has been paying that will not continue once you aren’t with the company are added to the EBITDA.

The Enterprise value is then expressed as a multiple of the EBITDA. The multiple depends on several factors and usually increases with the revenue or EBITDA of the company: As an example of how EBITDA is calculated let’s calculate it for our two management companies.

*Applying a 5x multiplier because of the revenue level of $2.5M revenue would result in a calculated Enterprise Value of $4,604,750.

*Since the Owner is currently managing eight communities, there will be an expense to hire someone to manage those communities. Therefore, the full owner salary of $205,000 will not be added back. We have arbitrarily used a manager salary of $140,000 resulting in a $65,000 add-back instead of $205,000.

Applying a 5x multiplier given the $2.5M revenue would result in a calculated Enterprise Value of $1,987,250. A value of $2.6 million less than CAMC RED!

Which company do you want to be selling?

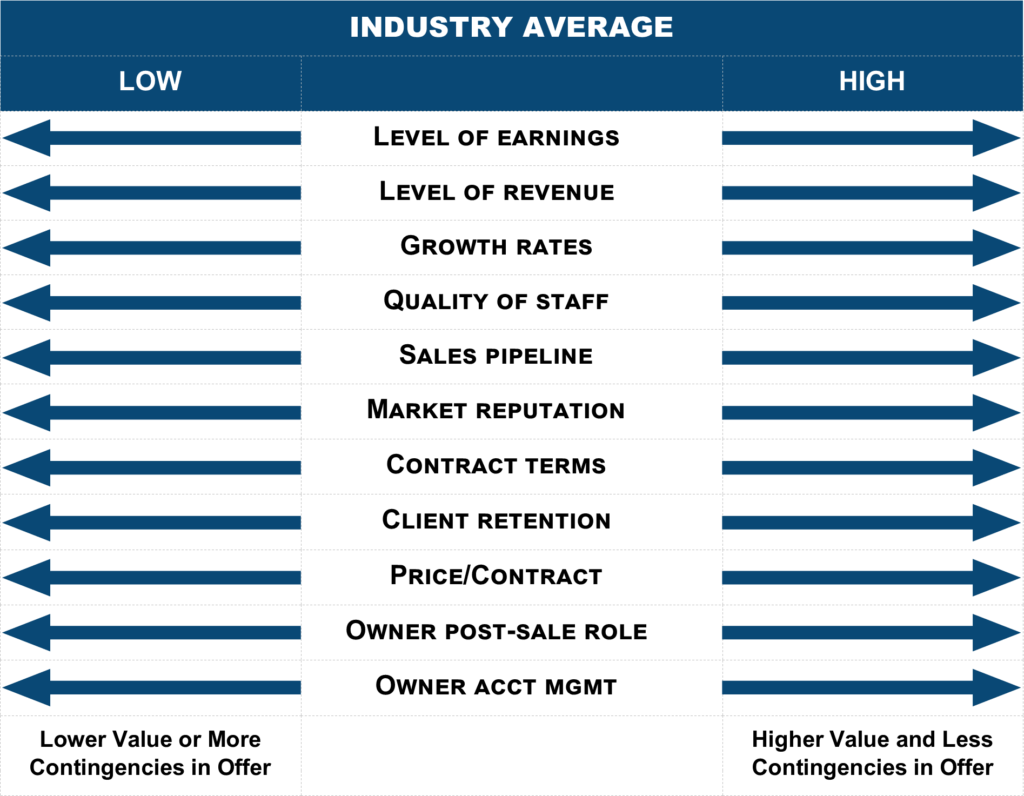

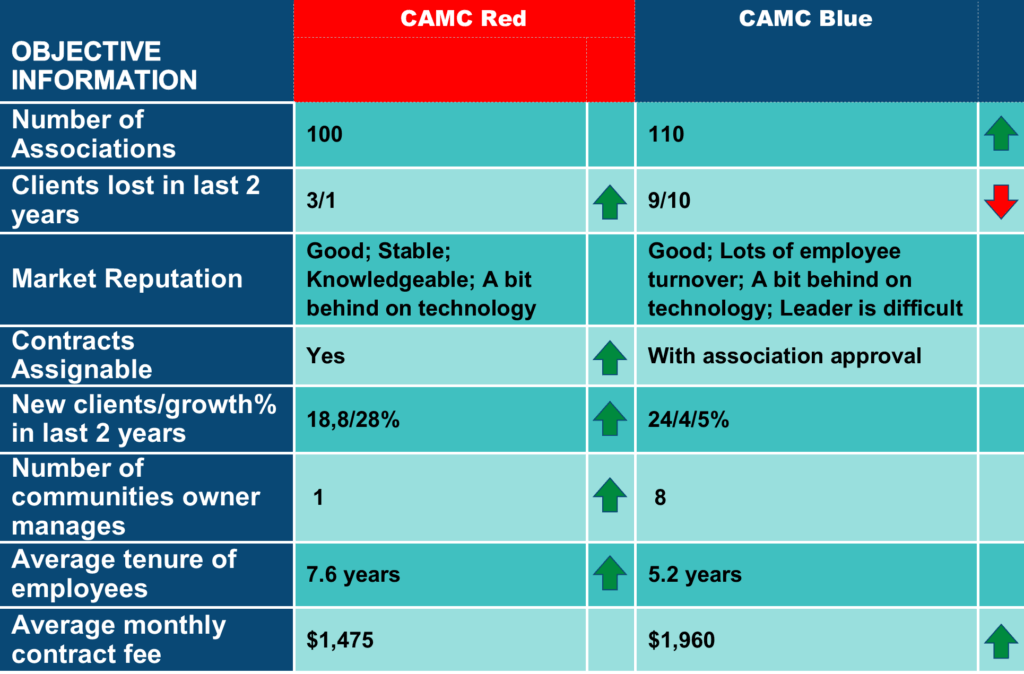

Adjustments Based on Industry/Market Comparables

As we all know, there are many more things that are more “intangible” that go into the value of a company. A potential buyer will look to see if any other adjustments should be made to the value based on industry or market factors viewed from the seller’s perspective.

These variables may not affect the value but may instead be addressed with certain contingencies within the offer. These factors are more subjective and each buyer may place different weight values on these factors.

Each of the factors listed below can have an impact on the value of your company depending on how low or high they are compared to the community association management industry averages.

For example, if your company has a no-sales pipeline, and its client retention is low, the value may decrease, or an offer you receive may contain certain contingencies to offset or minimize those risks.

Looking at the two management company’s objective information based on this scale, all the factors with green arrows (see table below) could result in possible increased value for the company and those with red arrows could lower the value or result in an offer having certain contingencies.

For example, because CAMC Blue has lost 19 clients in two years an offer might have a longer tail, meaning the full purchase price might be paid over 24 months or longer in an effort to minimize the risk to the buyer that clients will continue to leave and the revenue will decrease accordingly.

Once the buyer has determined their proposed value for your company, they will provide a Letter of Intent (“LOI”) with an offer amount.

Adjustments to Enterprise Value Based on Debt/Cash

If agreeable, then a period of due diligence occurs. This is an opportunity for the buyer to dig into the details of your company before they purchase it. Most buyers will be reviewing the following records which you should be prepared to produce as quickly as possible:

Financial reports All management contracts

All contracts to which the company is a party All employee records

Corporate records List of all communities, size, who manages

IT records related to software/hardware IT structure/providers

Standard operating procedures Pending/threatened claims against company

Documentation of all debt obligations Judgments against the company

All insurance policies All leases

Marketing plans/materials

After the due diligence period, the LOI is converted to an offer to purchase.

In addition to looking at how the financial information impacts the valuation of these two management companies, an understanding of the other major pieces that impact the sale of your management company sale will be necessary.

As mentioned before, the value of a business is often approached from an emotional level. It is a gut feeling of what you think the business should be worth, or what you have heard others are getting when they sell.

This can lead to a gap between reality and expectations. Understanding the valuation process and the factors that are considered can ensure your expectations are grounded in reality and that you are not disappointed by offers received. These include:

Timing Considerations

When is the “right” time to sell? There are generally three points at which an owner will decide the time is right:

- Personal Inflection Point – Your goals have changed. You want to focus on other things. It could be your family, health, hobbies, or you’re simply ready for the next chapter.

- Business Inflection Point – The business demands, capital requirements, human resource challenges, risk profile, or competitive context may have changed to the extent that you no longer want to shoulder the additional risk of taking your business to the next level or even maintaining what you have.

- Market Inflection Point – Market conditions dictate your readiness to sell.

Non-Economic Considerations

For many owners, some concerns are more or just as important as the value they will receive when they sell. The top concerns are:

- Company legacy and impact on the company’s employees and clients

- Timing based on life stages, such as health changes, retirement, care-taking responsibilities, etc.

- Impact on family members in the business or family succession plans

- Emotional attachments

- Post-sale role of owner

It is advisable to think through your desires and consult with trusted advisors with respect to all these issues before deciding to sell.

Having clarity around your desires and even non-negotiables related to these areas will help you ensure that any sale is successful for both you and the buyer.

It is also advisable that you seek advice related to wealth diversification, estate planning, and tax implications before any sale. As the majority of most business owner’s wealth is tied up in their company, planning for the liquidity of this wealth in order to maximize its benefits is essential.

Deal Structure Considerations

There are many ways to structure the purchase of a management company, and the determination is often negotiated between the parties. The primary consideration is whether the purchase is an asset purchase or a stock purchase.

Asset Purchase

In an asset purchase, the buyer will agree to purchase specific assets and liabilities such as management contracts, computers, furniture, etc., and may assume the liability for things like copiers, office space leases, and future liabilities after the closing of the sale.

Any assets or liabilities not included in the sale remain with your company. After the sale occurs, your company must be wound down including the disbursement of remaining assets and settlement of any liabilities.

Since the primary asset of most management companies is their management contracts, those contracts that are easily assigned will bring more value.

If your contracts require association approval or if assignment is prohibited this can be a deterrent to an asset purchase or have an impact on the value of your company as seeking approval puts each contract at risk.

Stock Purchase

A stock purchase means the buyer purchases your entire company, all its assets and liabilities as they exist at the time of closing. However, the buyer may not want to assume unknown or potential liabilities and there may be negative tax implications.

It is important to note the legal structure of your company will have tax implications for you. For example, if your company is a C corporation, the corporation will be taxed when it sells the assets and then you will be taxed when transferring those proceeds out of the corporation to you.

Addressing these issues with an advisor as you prepare your exit strategy can help you minimize your taxes and maximize the value you receive

The payment structure can take several forms and any combination of these:

Cash at closing

The amount of the purchase paid at closing can vary anywhere from 25-100% depending on the risks present. Therefore, options 2 and 3 below are often a part of any purchase.

Earnout

If there are risks involved in the purchase that may impact the continued revenue streams, such as a high risk of employees leaving and/or contracts being terminated, the buyer may pay 25-75% at closing and then make additional payments over 6-24 months based on the stability of employees and clients. The earnout can also be conditioned on certain growth happening post-closing,

A note payable to the seller

If there is not an earnout, the seller may choose to spread the total purchase price over several years to manage the risks involved. The payments made after closing would usually be secured by a seller’s note with specific payments and a maturity date of two to five years.

Tips for Exit Value Optimization

Every situation is different, but the more you can follow these tips, the higher the value of your company will be:

- Maintain several years of strong performance

- Minimize the number of associations personally managed by you (the owner)

- Establish a strong leadership team

- Resolve any pending claims against the company

- Ensure all management contracts are fully assignable without association approval (unless required by law)

- Ensure all company accounting records are up to date and complete

- Consider the timing of the renewal of leases

- Understand all tax implications of your sale

- Understand what role you would like to play post-sale

Plan Your Exit Wisely

According to the 2023 State of Owner Readiness Survey conducted by the Exit Planning Institute, 99% of business owners say the development of an exit strategy is important yet 50% of owners have no plan at all and 80% have no written plan.

As this Tale of Two Association Management Companies comes to an end, Dickens’ A Tale of Two Cities reminds us: “it is a far, far better thing [to] do, [to plan your exit], than [you will] ever [do]; it is a far, far better result than [you] will ever know.”

If you have any questions about what is covered in this article, aren’t sure where to start, or are looking for more resources, we’re here to help. Contact Keystone today.